In cryptocurrency, stablecoins are digital currencies designed to maintain a steady value by being tied to real-world assets like the US dollar. Unlike Bitcoin and other cryptocurrencies that can swing wildly in price, stablecoins offer stability by keeping their value constant. This unique feature has made them increasingly important in the crypto market, where they serve as a reliable way to trade, save, and transfer money without worrying about price fluctuations. Think of Stablecoins as a bridge between traditional money and the digital currency world, combining the stability of regular currencies with the advantages of cryptocurrency technology.

What is a Stablecoin?

A stablecoin is a type of cryptocurrency that maintains a fixed value by being linked to a stable asset, most commonly the US dollar. This means that one stablecoin token aims always to equal one dollar, providing a consistent and reliable value. Just as traditional banks keep real dollars to back their customer deposits, stablecoin companies hold reserves of actual assets to support their digital tokens.

Stablecoins come in different forms. Some keep real dollars in bank accounts to back their tokens. Others use cryptocurrencies as collateral, while some use computer programs to maintain value. The most popular stablecoins, like USDT (Tether) and USDC, are backed one-to-one with US dollars.

These digital tokens solve a major problem in the crypto world: extreme price swings. While Bitcoin and other cryptocurrencies can change dramatically in value throughout the day, stablecoins remain steady. This stability makes them useful for trading other cryptocurrencies, sending money internationally, or simply holding value in digital form without the stress of market volatility.

Types of Stablecoins

Stablecoins maintain their stable value in three main ways:

Fiat-Collateralized Stablecoins

These stablecoins are backed by real money, like US dollars, which are kept in bank accounts. For every digital token created, the company stores one dollar as backing. USDT (Tether) and USDC work this way, making them the most straightforward and popular type. You can think of them as digital versions of the cash in your bank account.

Crypto-Collateralized Stablecoins

These stablecoins use other cryptocurrencies to provide backing instead of real money. Because crypto prices can change quickly, they require extra cryptocurrency as security – often more than 150% of the stablecoins’ value. DAI is a well-known example of using Ethereum as collateral. This type works like a crypto loan, in which you deposit more crypto than you borrow.

Algorithmic Stablecoins

These stablecoins don’t use any backing at all. Instead, they use computer programs to control their supply, similar to how central banks manage regular money. When the price goes up, the program creates more tokens. When the price falls, it reduces the supply. While clever, this type is the riskiest and has seen some famous failures in the market.

Each type serves different needs in the crypto world, but they all share the same goal: keeping their value steady at one dollar or whatever asset they target.

How Do Stablecoins Work?

Stablecoins are digital currencies designed to maintain a fixed value, typically pegged at $1, through a strict 1:1 backing ratio. Every stablecoin issued must have one real dollar held in reserve. This 1:1 ratio is fundamental to the system. For example, when someone deposits $1,000, precisely 1,000 stablecoins are created. Users can always redeem their coins for real dollars at this same rate.

Furthermore, price stability is maintained through market forces, where traders can profit from price discrepancies by either creating or redeeming coins, naturally pushing the price back to $1. While dollars back most stablecoins, some use cryptocurrency as collateral instead, requiring over-collateralization to account for crypto’s price volatility.

However, transparency is vital to this system’s success. Stablecoin issuers must prove through regular third-party audits and transparent public reporting that they have enough dollars in reserve to back every coin in circulation. Without this transparency and proof of the 1:1 backing, users might lose faith in the system, potentially triggering a rush to redeem coins that could break the peg and collapse the stablecoin.

Benefits of Stablecoins in the Crypto Market

Stablecoins provide key benefits for crypto users and markets. First, they offer stability in a volatile crypto world. While Bitcoin and other cryptocurrencies can swing wildly in price, stablecoins maintain steady value by staying pegged to the dollar.

Traders use stablecoins as a safe place to park their money during market uncertainty. Instead of converting back to regular dollars (which means leaving the crypto ecosystem), they can quickly move into stablecoins. This helps them avoid withdrawal fees and delays from crypto exchanges.

Stablecoins also make everyday transactions more accessible. Since their value doesn’t change, people can use them to buy things or send money without worrying about price swings. For example, a coffee that costs five stablecoins today will cost the same tomorrow.

As a bridge between traditional money and crypto, stablecoins help people move between the two systems smoothly. Users can easily buy stablecoins with regular dollars, use them in the crypto world, and convert them back to dollars. This makes stablecoins particularly useful for international transfers and trading.

Additionally, stablecoins bring more liquidity to crypto markets. Traders can quickly buy and sell large amounts without causing significant price changes, which helps make the whole crypto market work better.

How Stablecoins are Changing the Crypto Market

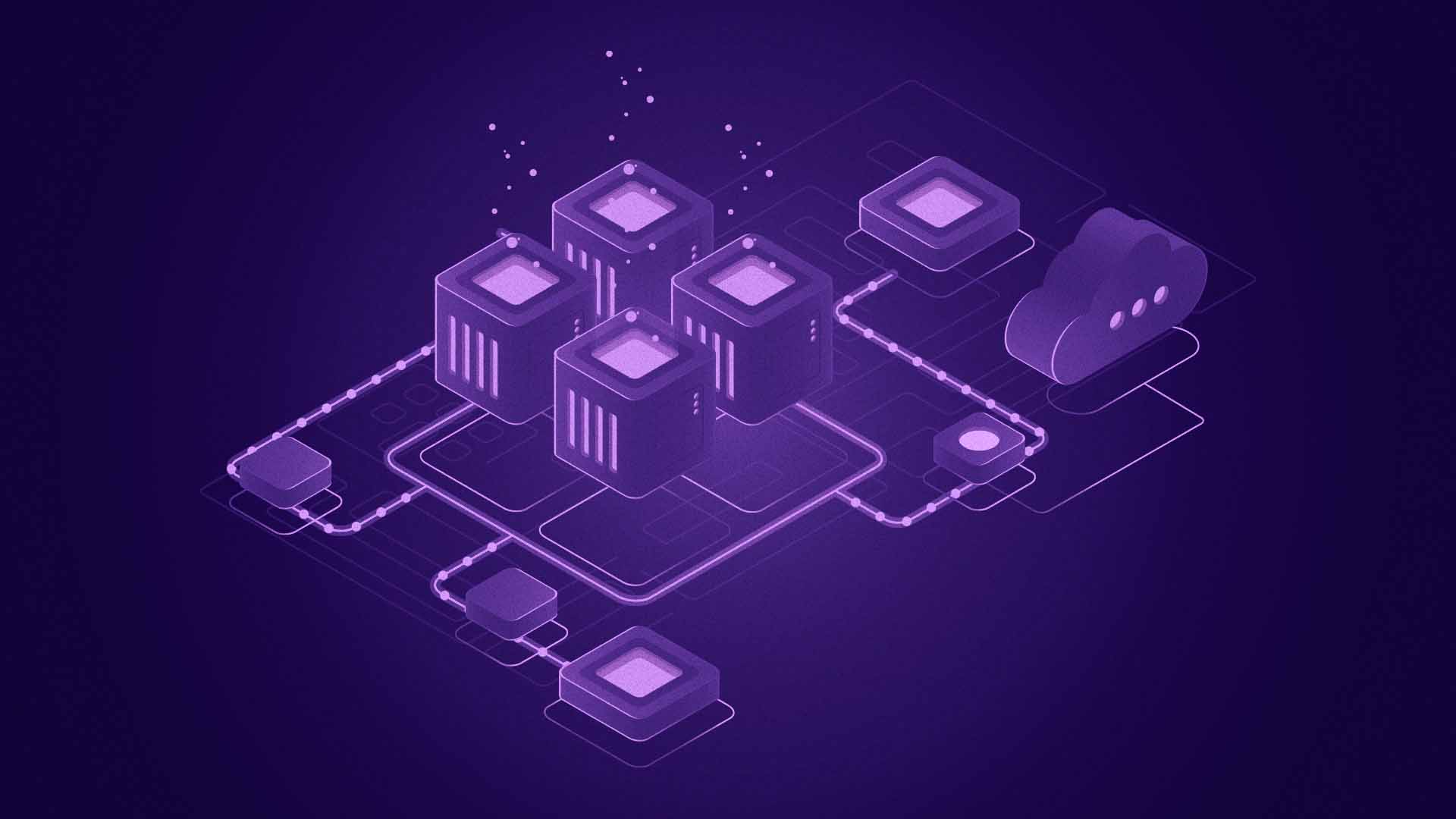

Stablecoins have revolutionized the cryptocurrency market by making it more accessible to cautious users who previously avoided crypto due to its volatility. These digital currencies, which maintain a steady value tied to the dollar, offer a familiar and less risky entry point into the crypto world. Their impact extends beyond just new user adoption – traders actively use stablecoins as a haven during market turbulence. At the same time, exchanges depend on them to provide stable trading pairs that improve market liquidity and efficiency.

In practical terms, stablecoins bring real-world utility to crypto: businesses can confidently accept them as payment, knowing their value will remain steady. At the same time, international transfers become faster and cheaper than traditional banking methods. The transparency of regular audits and reserve reporting builds trust in the system, attracting interest from traditional financial institutions.

By bridging the gap between conventional finance and crypto innovation, stablecoins make digital currencies more practical for everyday use while preserving the core benefits of blockchain technology. This stable foundation drives broader crypto adoption and integration into mainstream financial activities.

The Future of Stablecoins in Cryptocurrency

Stablecoins are reshaping how we use digital money in everyday life. Banks and financial companies now develop their stablecoin projects to make payments faster and cheaper. More retailers and payment apps are adding stablecoin options, making digital transactions accessible to everyone.

Technology improvements focus on security and efficiency. New features enable faster transactions and better fund protection, while smart contracts allow for automatic payments and programmable money functions. As regulatory frameworks develop, stablecoins integrate more smoothly with traditional banking systems.

The real power of stablecoins lies in connecting different financial systems. They bridge traditional banking with crypto markets, enabling new services that combine the best of both worlds. This integration supports global commerce and brings financial services to more people worldwide.